(plot Data = close )ĭef data = if !isNaN(vol) then vol else vol

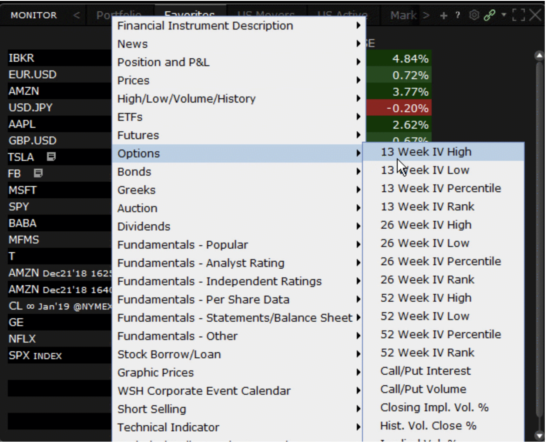

IV Rank Script : taken from .Ĥ) Delete everything in the box. But I like it because I can quickly see the volatility relationship between past volatility and quickly determine what side of the trade is likely more beneficial. Individual indicators don’t have to tell a complete story themselves, they only have to add a verse to the page and that’s all IV rank does for us or is intended to do. It’s just another way to use the tool in our belt. This isn’t to say it can’t stay high or low for long periods of time, because it absolutely can. How? Well, when volatility is high it can only go lower and when it’s low it can only go higher. It can help shed some light on the future direction of an underlying. You may have also noticed another useful caveat associated with the IV rank. Likewise, if IV is low then premiums are low and we’re suggested to be net buyers. If uncertainty is high we should be compensated for the expected extreme moves.

When IV is high there is more uncertainty in the market and large moves are expected. When IV rank is high we want to be sellers of options and when it’s low we want to be buyers. It helps us determine whether its more beneficial to be net buyers or net sellers of options. If the IV rank of SPY is at 11% today, that means over the past year IV has been lower than its current position only 11% of the time (or higher 89% of the time).

0 kommentar(er)

0 kommentar(er)